Medicare Part D

Prescription Drug Plans

2025 Part D Plan Changes

How Drugs are priced...

Prescription Discount Companies

Prescription Drug Plans in Medicare…

- Part D Prescription Drug Plans are offered through a variety of insurance companies on a standalone basis or they can be included in your Medicare Advantage plan. There are a number of standalone plans as well as Medicare Advantage plans with Part D coverage available in each state. Your most appropriate solution depends on the medications you anticipate filling and the pharmacy you prefer to shop.

Plans vary based on:

-

- Monthly premium

- Formulary List (which prescriptions they cover)

- Tier assignments for each covered medication

- Copay amounts during initial coverage stage

- Network pharmacies

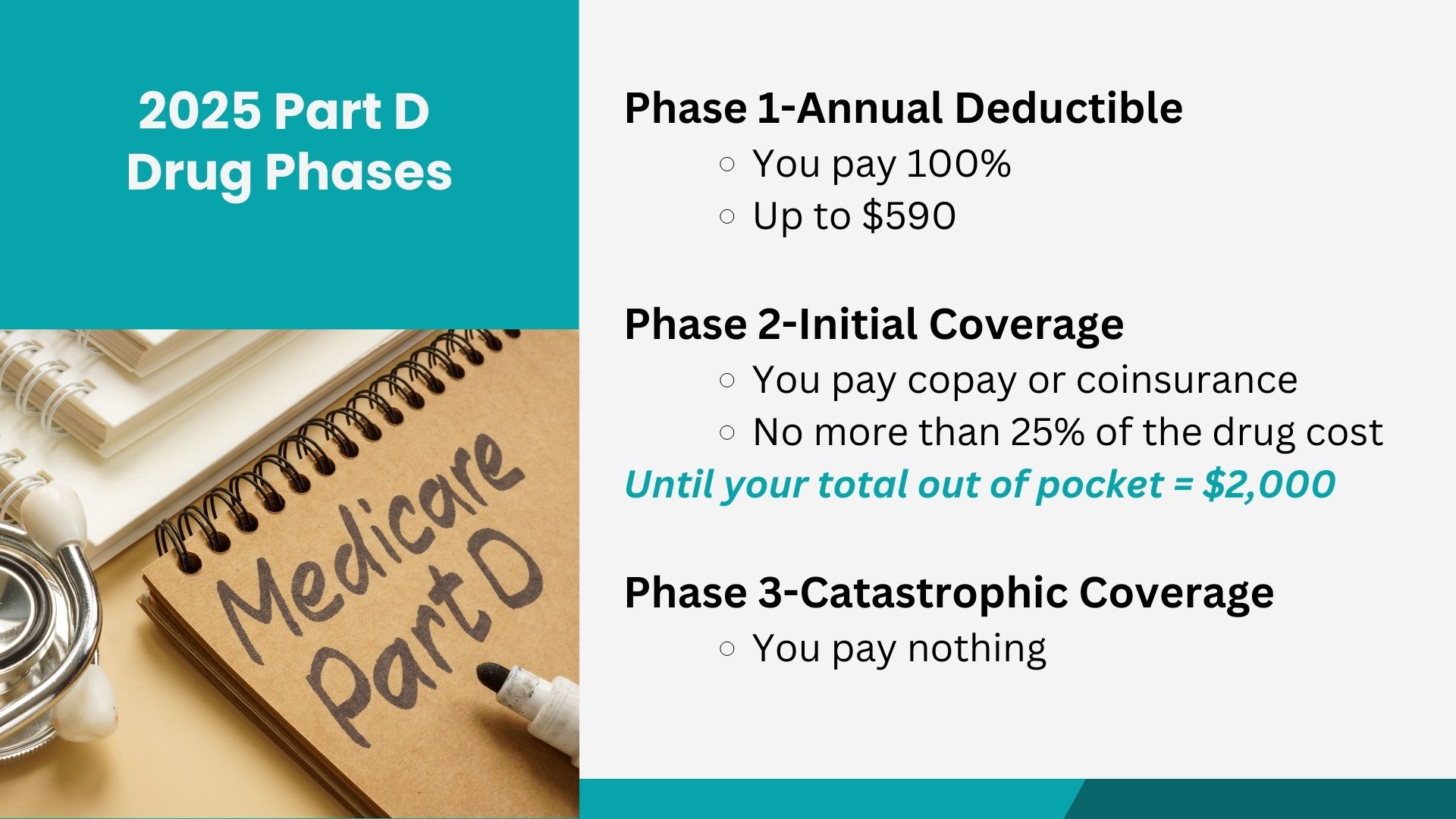

Prescription Drug Plan Phases in 2025

One of the key component’s to the Inflation Reduction act is the removal of the Donut Hole/Coverage Gap. In 2025 Part D plans will only have 3 Phases.

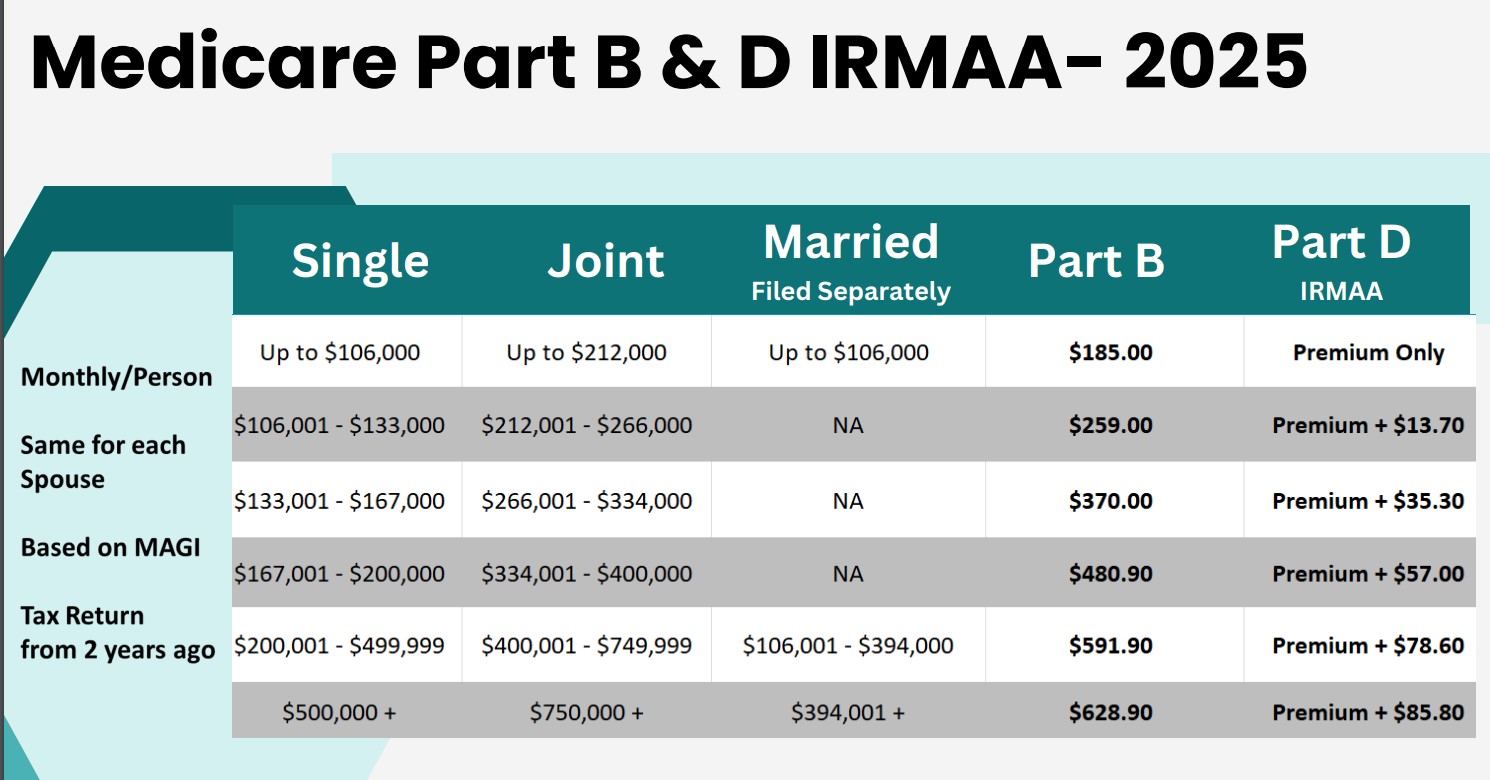

Part D High Income Surcharge- IRMAA

If you earn more than the base income tier, you will receive an income surcharge on your Medicare Part D Prescription Plan. This surcharge will be billed directly by Social Security with your Part B premium (if you are collecting Social Security Income, this amount is automatically withdrawn from your Social security check once you enroll in a Part D Plan.

Do I need a Prescription Plan if I don’t take Prescriptions?

Although you are not required to enroll in a Part D Prescription plan, there are two main issues with not enrolling: Penalties and Deadlines

Can I use outside discount drug programs (like GoodRx) with my Part D Plan?

You can use either your Part D plan or a drug discount card for medications, but not both for the same prescription. Check the price on the discount program’s website before going to the pharmacy. If your Part D plan price is higher, ask to use the discount program instead. Keep in mind that Medicare plans may have deductibles, so your initial costs could be high but may drop after meeting the deductible. However, paying outside your plan won’t count toward your deductible, so sometimes it makes sense to pay more under the plan to meet it.

Visit the following pages for more information on plan options

Medicare Supplement Plan Options

Medicare Advantage Plan Options

Medicare Part D Prescription Plans