Medicare Advantage Plans

Medicare Advantage Plans (aka Medicare Part C Insurance)

work as your primary insurance to replace Medicare A and B (however, you are still responsible for paying your Medicare Part B premiums).

Medicare Advantage Plans are an “all in one” plan that can include Prescription Drug Benefits and even some ancillary benefits like dental, vision, hearing, and gym memberships.

All Medicare Advantage (MA) plans must cover all Part A and Part B benefits. Most MA plans also cover part of the Original Medicare cost sharing benefits.

Certain chronic health conditions and/or low income may qualify you for a Specials Needs MA Plan.

For more information, please read this article published by Forbes Magazine in 2022 titled: Why Are Medicare Advantage Plans So Heavily Advertised?

Differences between MS and MA- 12m 40s

What to look for when shopping Medicare Advantage Plans

All Medicare Advantage Plans work differently. Although there are various comparison softwar0’se available that provide a high-level comparison, only the formal Summary of Benefits and Evidence of Coverage documents provided by the different insurance companies tell the full story of how each plan works and the benefits provided.

- What type of network coverage? HMO, PPO, etc

- Do your providers accept the plan?

- Copays of various services

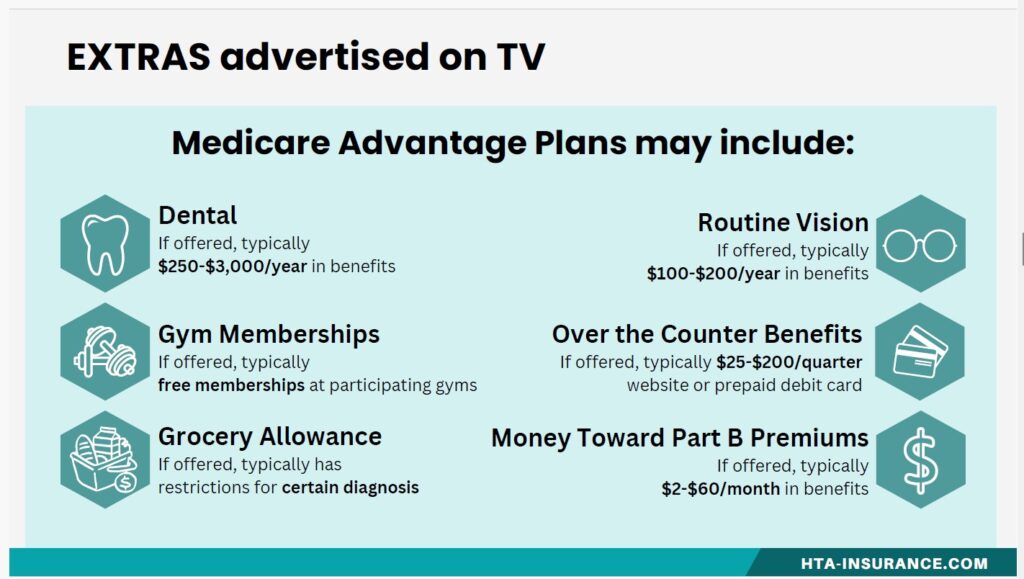

- Extra Benefits

- Prescription Benefits

Network Based Coverage

Medicare Advantage Plans have their own doctor networks. There are various types of network arrangements to choose from: HMO, PPO, PFFS, MSA.

Networks may be regionally based. It is important to know if you travel regularly or have multiple residences when choosing a proper plan.

Copays and Out of Pocket Limits

Premiums for Medicare Advantage plans are typically lower than Medicare Supplement premiums, but they may have higher maximum out of pocket limits. In 2024, the Maximum In Network out of pocket limit that can be on any plan is $8,850 for in-network. Out of Pocket limits may be lower depending on plan. Most plans have a schedule of copays that you will pay depending on each covered service until you reach your Maximum Out of Pocket (MOOP).

Many plans have a copay/coinsurance of 20% for chemotherapy and Part B drugs. This is likely to be your biggest expense in a Medicare Advantage plans.

Your Part D prescription costs do NOT count toward your out of pocket maximum.

Do all of your providers accept the coverage?

It is imperative that we check the plan’s participating provider list to make sure your doctors participate with the coverage. It is important to know that each plan can have a different network (so even if you are looking at 2 different plans with the same insurance company, they may have 2 different lists of participating doctors).

Providers enter and exit networks based on their contract -not the plan year. This means that providers may enter or exit a network mid plan year. This does not give you a special enrollment period to change plans. You can only change Medicare Advantage plans during the annual enrollment period.

Please be prepared with a complete list of your preferred doctors and hospitals for any phone appointment that may be shopping your coverage.

Shopping Extra Benefits

Re-Evaluating your Plan

Changing to Medicare Supplement: We recommend that you check in within the first 6 months you are on your first Medicare Advantage plan to let us know how you like the coverage. If you decide that you would rather go with a Medicare Supplement Plan, you will have the most options available to you in the first 6 months. However, there may be limited options available within 12 months depending on your circumstances. After 12 months, you will be able to go back to Original Medicare, but a qualifying for a Medicare Supplement plan will depend on medical underwriting.

Changing to a different Medicare Advantage Plan: The Annual Enrollment Period (10/15 to 12/7) and the Medicare Advantage Open Enrollment Period (1/1 to 3/31) is the only time you can change your Medicare Advantage Plan. You can change annually with no medical underwriting. Besides that, you are locked in to an annual contract.

When Can I Change My Plan- 4mins

Visit the following pages for more information on plan options

Medicare Supplement Plan Options

Medicare Advantage Plan Options

Medicare Part D Prescription Plans