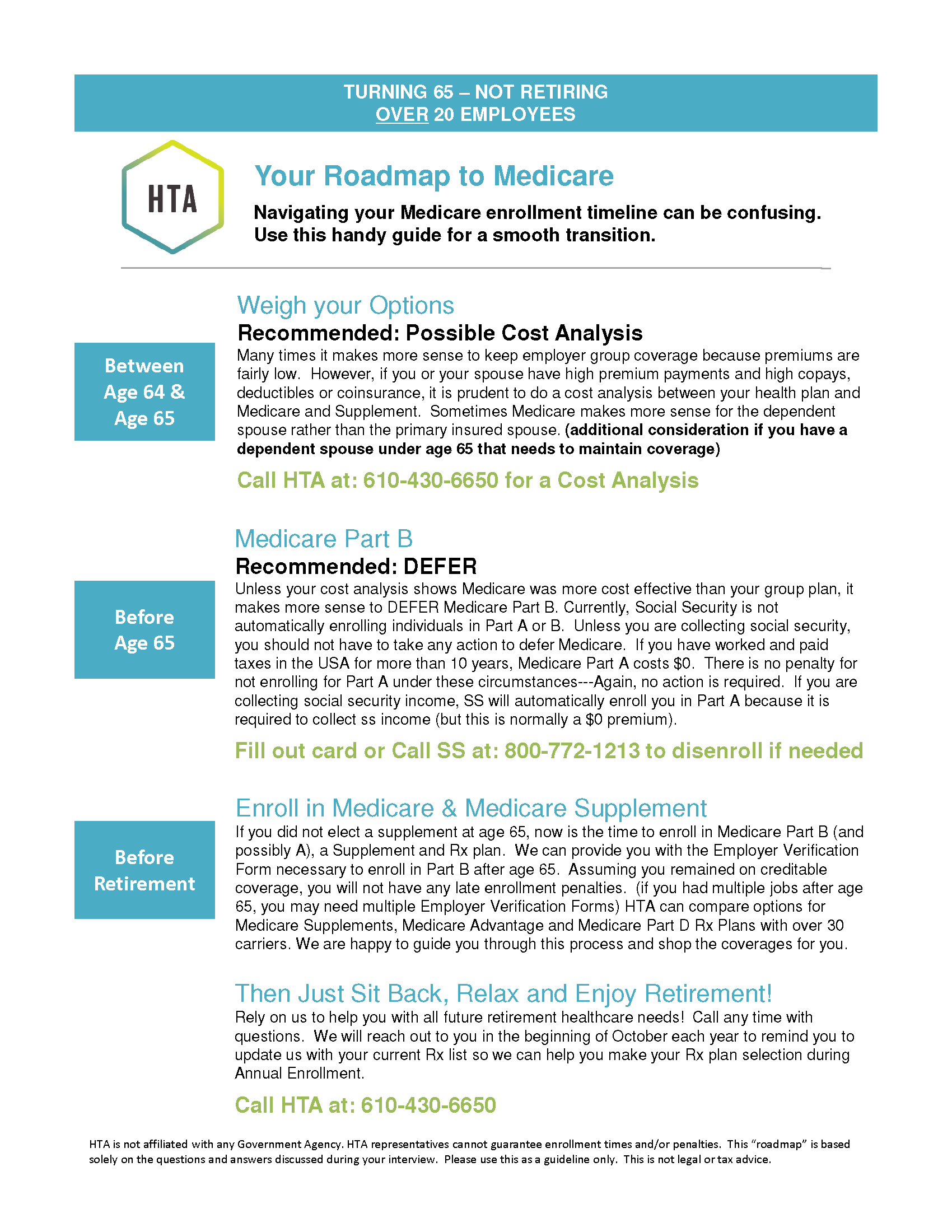

Roadmap to Medicare

SSDI

Customized Roadmap Report

Click on the image to download your 1 page Roadmap

Enrolling in Medicare

You will be automatically enrolled in Medicare Parts A and B effective after 24 months of SSDI.

Since you are collecting SSDI (Income), you are required to keep your Medicare Part A. You will have the option to keep or return your Medicare Part B. In your circumstances, it is advised that you Keep Part B.

To avoid potential gaps in coverage, penalties, and/or deadlines, you may want to…

Your Roadmap is based on…

- You are under age 65, but qualifying for Medicare due to SSDI

- You have Individual Health Insurance or you do/will not have any other coverage

Do I need Medicare to have full coverage?

Yes. Medicare will become your Primary Insurance once you are eligible.

Will I receive a penalty if I don’t enroll now?

Yes. You will receive late enrollment penalties, assuming you do not have creditable large group coverage.

What is my deadline to enroll?

It is advisable keep your Medicare Part A and Part B when it is automatically issued to you (after 24 months of SSDI).

Secondary Insurance Options

You have the option to purchase secondary coverage to supplement your Medicare A and B. You will have the option to choose a Medicare Advantage Plan or Medicare Supplement Insurance and a Medicare Prescription Drug Plan. For under age 65, options vary by state.

Premiums, Benefits and Networks may vary by insurance company. We represent over 30 different insurance carriers to help you review and evaluate which options are most appropriate for your situation.

In addition, you can also voluntarily elect Dental, Vision, Hearing, Cancer and/or Hospital Indemnity coverage.

Please contact us for quotes and benefit information.

Underwriting Considerations

Once you enroll in Medicare Part B, you will have an Open Enrollment Period/Special Election Period to choose your secondary coverage without having to medically qualify.

When under age 65 and on SSDI, plan availability is state specific. Please see HTA for plan options.

Additional Considerations

Spouse Under Age 65- If you have a Spouse under age 65, not yet qualified for Medicare, and relies on your group health plan for benefits, please be mindful that if you come off your group plan, your spouse will have to go on COBRA, seek benefits through their respective employer, or purchase individual health insurance until they become Medicare eligible.