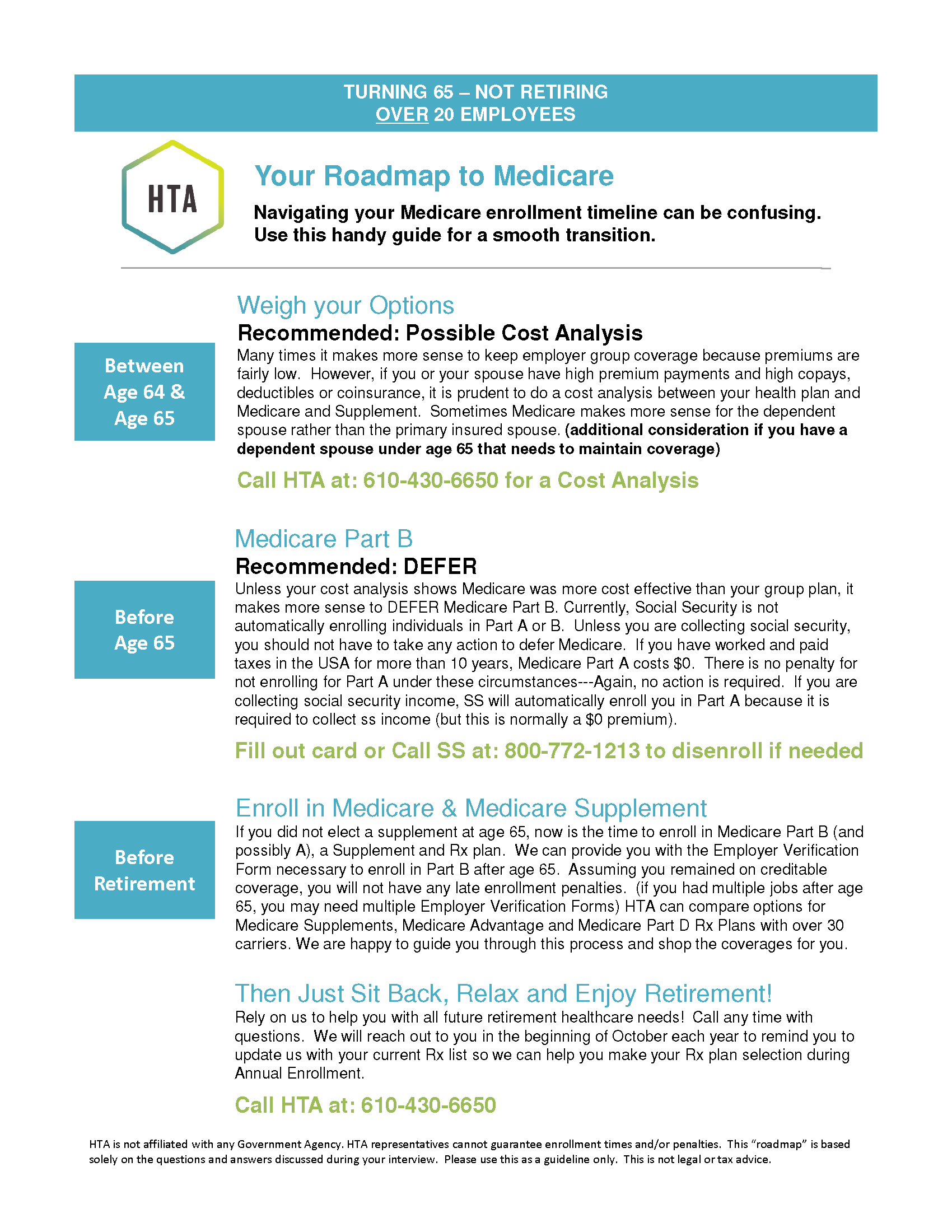

Roadmap to Medicare SSDI Under 100 Employees HSA

Customized Roadmap Report

Click on the image to download your 1 page Roadmap

HSA Considerations

You can no longer contribute to a Health Savings Account (HSA) once you enroll in Medicare Part A. Click on the link above for more details on HSAs and Medicare.

Enrolling in Medicare

You will be automatically enrolled in Medicare Parts A and B effective after 24 months of SSDI.

Since you are collecting SSDI (Income), you are required to keep your Medicare Part A. You will have the option to keep or return your Medicare Part B. In your circumstances, it is advised that you Keep Part B.

To avoid potential gaps in coverage, penalties, and/or deadlines, you may want to…

Your Roadmap is based on…

- You are under age 65, but qualifying for Medicare due to SSDI

- Your Primary Insured intends to remain ACTIVELY WORKING (at the employer providing your benefits)

- You ARE covered under the group health insurance plan

- The employer providing health insurance has LESS THAN 100 employees

- You ARE contributing to a Health Savings Account (HSA)

Do I need Medicare to have full coverage?

Yes. Medicare will become your Primary Insurance once you are eligible. You can keep your Group Health Plan as Secondary Insurance or you can choose private secondary insurance.

Will I receive a penalty if I don’t enroll now?

Unsure. Medicare regulations are unclear as to if one will receive a penalty for not enrolling in Medicare Part B if you are receiving Social Security Disability Income and are also covered by a small group health plan (less than 100 employees).

What is my deadline to enroll?

Unsure. To be cautious, it is advisable keep your Medicare Part B when it is automatically issued to you (after 24 months of SSDI). Medicare regulations are unclear and it appear that you only have a Special Enrollment Period if your group size is over 100 employees.

Secondary Insurance Options

Since your group health benefits are likely considered secondary insurance to Medicare, you MUST be enrolled in Medicare A and B to have full coverage. You will have the option to keep your Group Health Plan as secondary or elect a Medicare Supplement and Medicare Prescription Drug Plan or a Medicare Advantage Plan as secondary.

Underwriting Considerations

Once you enroll in Medicare Part B, you will have an Open Enrollment Period/Special Election Period to choose your secondary coverage without having to medically qualify.

When under age 65 and on SSDI, plan availability is state specific. Please see HTA for plan options.

Additional Considerations

Spouse Under Age 65- If your spouse relies on your group health plan for benefits, please be mindful that if you come off your group plan, your spouse will have to go on COBRA, seek benefits through their respective employer, or purchase individual health insurance until they become Medicare eligible.

Important HSA Considerations– You cannot continue to contribute to your Health Savings Account (HSA) once you enroll in Medicare Part A. If you are enrolling in Medicare after age 65, your Part A effective date may be back dated up to 6 months. Please contact us to discuss the HSA maximum contribution rate for you circumstances. Click Here for Details and Rules.

- This does not apply to Flexible Spending Accounts (FSA) or Health Reimbursement Accounts (HRA). Medicare does not have any restrictions on these types of accounts.