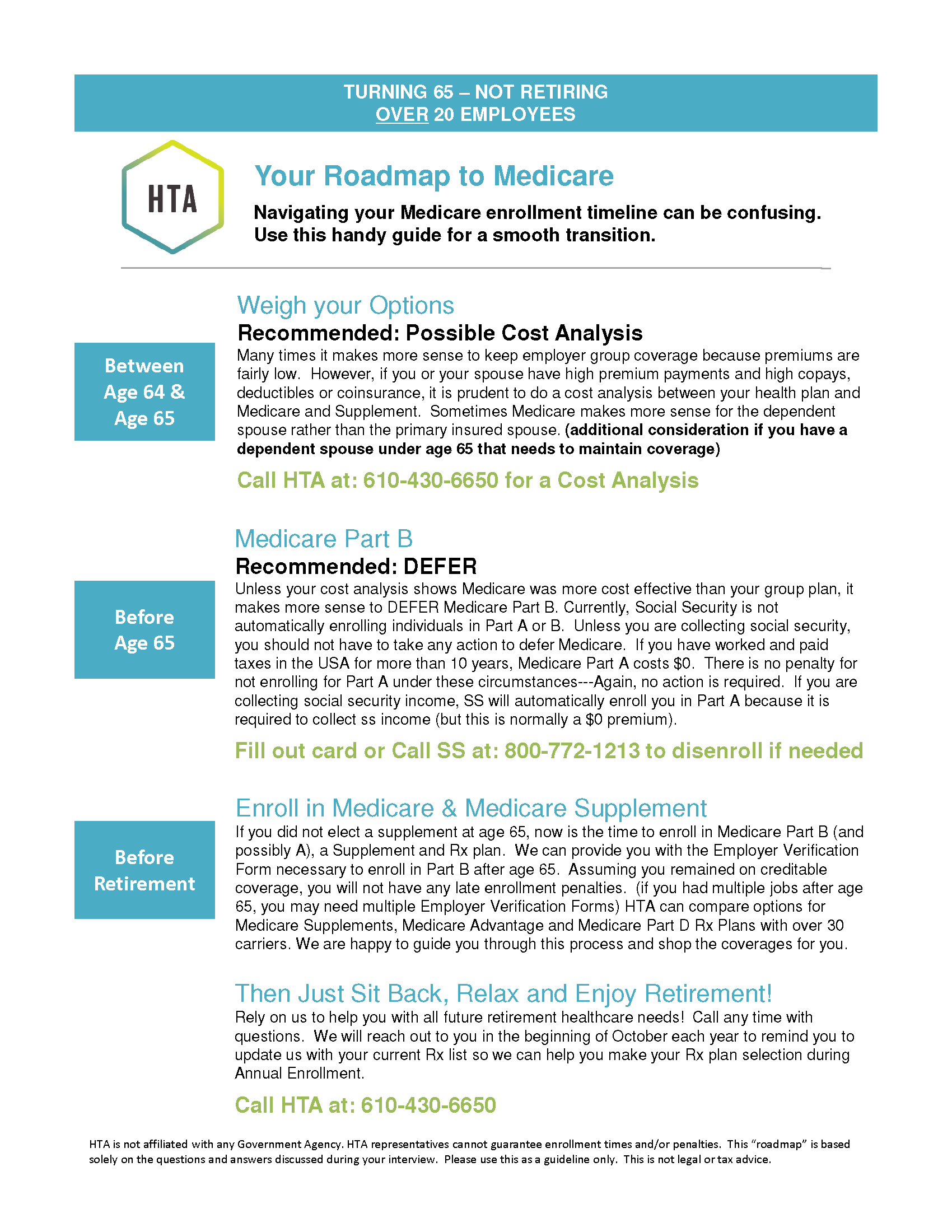

Roadmap to Medicare SSDI Over 100 Employees HSA

Customized Roadmap Report

Click on the image to download your 1 page Roadmap

HSA Considerations

You can no longer contribute to a Health Savings Account (HSA) once you enroll in Medicare Part A. Click on the link above for more details on HSAs and Medicare.

Enrolling in Medicare

You will be automatically enrolled in Medicare Parts A and B effective after 24 months of SSDI.

Since you are collecting SSDI (Income), you are required to keep your Medicare Part A. You will have the option to keep or return your Medicare Part B. After reviewing ALL of the information on this webpage, click on Keep Part B or Return Part B for detailed enrollment/deferral instructions based on your situation.

If your Group Health Plan is cost effective and provides comprehensive coverage, you may want to…

If you would like supplement your Group Health Plan, or Medicare is more cost effective than your Group Health Plan, you may want to…

Your Roadmap is based on…

- You are under age 65, but qualifying for Medicare due to SSDI

- Your Primary Insured intends to remain ACTIVELY WORKING (at the employer providing your benefits)

- You ARE covered under the group health insurance plan

- The employer providing health insurance has MORE THAN 100 employees

- You ARE contributing to a Health Savings Account (HSA)

Will I receive a penalty if I don’t enroll now?

No. You will not receive a late enrollment penalty provided you remain covered under the group creditable coverage and your primary insured remains actively at work at the employer that provides your benefits and the employer providing the benefits has over 100 employees.

What is my deadline to enroll?

You can enroll in Part B anytime up to 8 months after your large group coverage or the employment that it is based on ends.

Do I need Medicare to have full coverage?

No. Your group coverage should remain primary insurance as long as the employment that it is based on continues.

Secondary Insurance Options

Since your current plan will remain primary to Medicare as long as you remain enrolled in it, Medicare B is not required to have full coverage at this time. (Medicare Part A is required because you are collecting Social Security Income). You will have the option to keep your Group Health Plan or switch to Medicare and elect a Medicare Supplement Insurance Plan or Medicare Advantage Plan and Medicare Prescription Drug Plan.

Underwriting Considerations

Once you enroll in Medicare Part B, you will have an Open Enrollment Period/Special Election Period to choose your secondary coverage without having to medically qualify.

When under age 65 and on SSDI, plan availability is state specific. Please see HTA for plan options.

Additional Considerations

Spouse Under Age 65- If your spouse relies on your group health plan for benefits, please be mindful that if you come off your group plan, your spouse will have to go on COBRA, seek benefits through their respective employer, or purchase individual health insurance until they become Medicare eligible.

Important HSA Considerations– You cannot continue to contribute to your Health Savings Account (HSA) once you enroll in Medicare Part A. If you are enrolling in Medicare after age 65, your Part A effective date may be back dated up to 6 months. Please contact us to discuss the HSA maximum contribution rate for you circumstances. Click Here for Details and Rules.

- This does not apply to Flexible Spending Accounts (FSA) or Health Reimbursement Accounts (HRA). Medicare does not have any restrictions on these types of accounts.