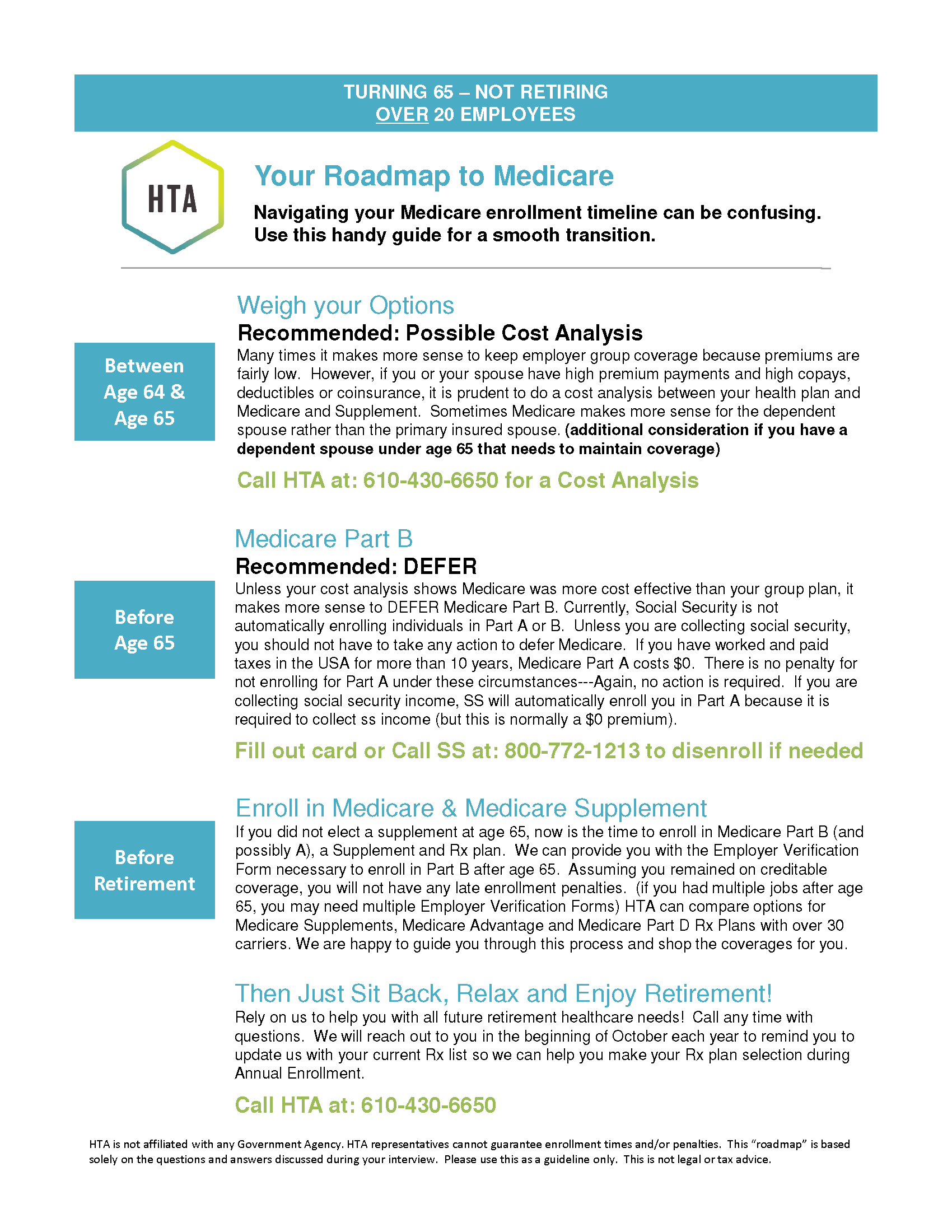

Roadmap to Medicare

Over 65, Severance

Customized Roadmap Report

Click on the image to download your 1 page Roadmap

Enrolling in Medicare

After reviewing ALL of the information on this webpage, click on Enroll Now for detailed enrollment instructions based on your situation.

Since Medicare is most likely your PRIMARY Insurance, and you may have penalties and deadlines for not enrolling in Medicare, you may want to…

Your Roadmap is based on…

- You are Over Age 65 and did not enroll in Medicare A (and/or) B at age 65

- Your Primary Insured IS NOT (or WILL NOT be) actively working at the employer providing your benefits

- You ARE (or WILL be) covered under the group health SEVERANCE program

Do I need Medicare to have full coverage?

Yes/Likely. Once you are no longer actively employed, it is likely that your Severance coverage will become secondary coverage and Medicare will become the primary insurance. If you do not enroll in Medicare, you may not have full coverage.

- Questions to ask your Severance plan when retire:

- Will my benefits change now that I am no longer working?

- Will my premiums change?

- Can my spouse get this benefit if I do not enroll?

- Will benefits and/or premiums change for my spouse should my passing occur first?

- Will the Severance plan act as primary insurance or do I need to have Medicare A and B as primary insurance to my plan?

If you wish to defer enrollment in Medicare A and/or B, please confirm from your Severance plan health insurance carrier (in writing recommended) that they will remain the primary payer or you could have significant gaps in your coverage.

Will I receive a penalty if I don’t enroll now?

Yes. You will receive a late enrollment penalty because Severance coverage is not considered creditable coverage to Medicare. Creditable coverage is defined as group coverage based on current active employment. Your Severance coverage is not based on active employment.

What is my deadline to enroll?

You can enroll anytime after age 65 up to 8 months after your group coverage or the employment that it is based on ends.

Secondary Insurance Options

Since your Severance benefits are likely considered secondary insurance to Medicare, you MUST be enrolled in Medicare A and B to have full coverage. You will have the option to keep your Severance plan as secondary or elect a Medicare Supplement and Medicare Prescription Drug Plan as secondary.

Underwriting Considerations

Medicare Supplement Insurance has an Open Enrollment Period for the first 6 months that you are enrolled in Medicare Part B. During this time, you will be able to purchase ANY medicare supplement plan with no medical underwriting.

If you stay with your Severance plan and decide to elect a Medicare Supplement later (when Severance ends, but you have already been on Medicare for more than 6 months) you will have SOME plans available on a Guaranteed Issue basis. There will be less options available that do not require you to answer medical questions to qualify.

Medicare Advantage Plans and Medicare Prescription Drug Plans provide an Initial Election Period when you enroll in Medicare, a Special Election Period when you come off your Severance plan, and also allow you to change plans once a year during the Annual Election Period (October 15th through December 7th) without medical underwriting.

Additional Considerations

Important HSA Considerations– You cannot continue to contribute to your Health Savings Account (HSA) once you enroll in Medicare Part A. If you are enrolling in Medicare after age 65, your Part A effective date may be back dated up to 6 months. Please contact us to discuss the HSA maximum contribution rate for you circumstances. Click Here for Details and Rules.

- This does not apply to Flexible Spending Accounts (FSA) or Health Reimbursement Accounts (HRA). Medicare does not have any restrictions on these types of accounts.