Commercial Insurance

Business Owners Plan (BOP)

Purpose of BOP Coverage

This business insurance provides a commercial package of various insurances that are typically most attractive to small to mid size businesses.

By combining the most commonly chosen benefits into a single plan, premiums become more affordable.

Protecting Others

Medical Payments

We will pay medical expenses as described below for “bodily injury” caused by an accident:

- On premises you own or rent

- On ways next to premises you own or

rent - Because of your operations

We will make these payments regardless of fault. Limit is typically $10,000 per person

Business Liability

We will pay those sums that the insured becomes legally obligated to pay as damages because of

- bodily injury

- property damage

- personal and advertising injury

to which this insurance applies. We will have the right and duty to defend the insured against any “suit” seeking those damages. You choose the amount of liability protection that is appropriate for your situation.

Personal Injury/Slander

Protects you in the event you get sued for slander. This is not covered by all policies.

Additional Property Loss Payee

Those you have lease agreements with for leased equipment or property

Damage to Premises Rented to You

Business Liability coverage includes property damage to premises rented arising out of fire, lightning or explosion. This coverage also includes property damage to premises rented by the insured for 7 days or less. The Damage To Premises Rented To You Limit is shown in the Declarations. The limit of insurance is the same as the Occurrence Limit, up to $1,000,000.

What happens if I am sued?

The personal liability portion of your home insurance policy can help provide legal defense, regardless of the outcome of the suit. Homeowners liability coverage also may help pay the other party’s medical fees or repairs you may owe.

The Insurance Information Institute (III) notes that the types of incidents personal liability insurance can help cover include:

- Damage or injuries caused by pets

- Unintentional damage or injuries caused by you or family members

- No-fault medical coverage if a friend is injured in your home

Coverage typically start at $100,000. It’s important to choose limits that fit your situation.

Please note that if your policy does not have coverage for Personal Injury/Slander, you may not have coverage.

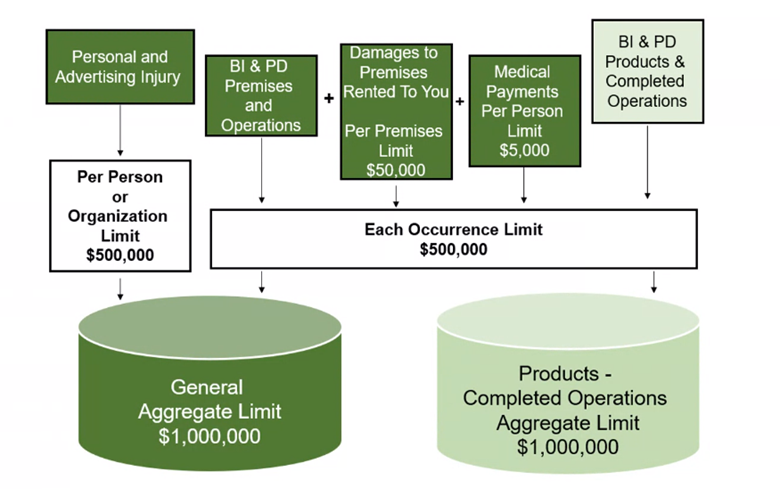

Aggregate Limits

Liability Coverages is listed in Per Occurance limits with apply to a Policy Aggregate Limit.

Protecting You

Covered Property

Pays for damage to your house and structures attached to your house. This includes damages to fixtures such as plumbing, electrical wiring, heating, and permanently installed cooling systems.

Business Personal Property

The Business Personal Property definition includes the following as Covered Property:

- Personal Property of Others held by the Insured but belonging in whole or in part to others.

- Tools and Equipment owned by insured’s employees used in the insured’s operations.

- Tenant Improvements and Betterments that are part of a non-owned building the insured occupies but can’t legally remove.

- Leased personal property which the insured has a contractual responsibility to insure, except as provided by Personal Property of Others.

Endorsements

EQUIPMENT BREAKDOWN ENHANCEMENT ENDORSEMENT

CONTRACTORS EXTENSION ENDORSEMENT

INSTALLATION COVERAGE – SPECIAL FORM

Contractors Inland Marine Endorsement

EQUIPMENT BREAKDOWN ENHANCEMENT ENDORSEMENT

Buidling (if applicable)

Collapse

Electronic Data And Computers

We will pay for direct physical loss or damage to “Electronic Data” and “Computers” at the described premises resulting from a Covered Cause of Loss including “electronic vandalism”.

Debris Removal

Reimburses you for damage to or theft of your personal property. This covers things like furniture, appliances, electronics, lawn equipment, clothing, etc. It also protects your belongings even when they aren’t on your property. Typical coverage for loss of use is 20 percent of the dwelling coverage limit.

Water Damage, Other Liquids, Powder Or Molten Material Damage

Choose a specific dollar amount if water backs up through a sewer or drain, or overflows from a sump pump. This is not covered by all policies.

Business Personal Property

Reimburses you for damage to or theft of your business personal property. This covers things like furniture, appliances, electronics, lawn equipment, clothing, etc. It also protects your belongings even when they aren’t on your property. You can choose to insure your personal property at the replacement cost or actual cash value.

Keep in mind that coverage for some property such as jewelry, furs, antiques, coins, guns, and art may be limited. You can purchase additional coverage called a scheduled personal property endorsement to better protect these items.

Property off Premises

You may extend the insurance provided by this policy to apply to your Covered Property while:

(1) In the course of transit;

(2) Temporarily at a premises you do not own, lease or operate;

(3) At any fair, trade show or exhibition, or

(4) In the care, custody or control of your salespersons.

Business Income And Extra Expense

Business Income will pay for the actual loss of business income due to the necessary suspension of your operations during the period of restoration. “suspension” must be caused by direct physical loss of or damage to property at the described premises.

Coverage is provided to pay for Actual Loss Sustained of Business Income and necessary Extra Expense during the “period of restoration” from a covered cause of loss to property at the scheduled premises. There is no deductible or waiting period applied to this coverage except as identified below and as applicable in specific optional coverages.

- Net Income (Net Profit or Loss before income taxes)

- Continuing normal operating expenses incurred, including payroll.

Extra Expense will pay for any extra expenses you incur during the period of restoration that would not have occurred if you did not have loss or damage to the property.

Employee Dishonesty

(1) You may extend the coverage that

applies to Business Personal

Property to apply to direct loss of or

damage to Business Personal

Property and “money” and

“securities” resulting from dishonest

acts committed by any of your

employees acting alone or in

collusion with other persons (except

you or your partner) with the manifest

intent to:

(a) Cause you to sustain loss or

damage; and also

(b) Obtain financial benefit

Ordinance Or Law

In the event of damage by a Covered Cause of Loss to a building that is Covered Property, we will pay for:

- Loss To The Undamaged Portion Of The Building

The loss in value of the undamaged portion of the building as a consequence of enforcement of an ordinance or law that requires demolition of undamaged parts of the same building. - Demolition Cost The cost to demolish and clear the site of undamaged parts of the same building, as a consequence of enforcement of an ordinance or law that requires demolition of such undamaged property.

- Increased Cost Of Construction

Ordinance Or Law – Increased Period Of Restoration

We will pay for the actual loss of Business Income you sustain and reasonable and necessary Extra Expense you incur during the increased period of “suspension” of “operations” caused by or resulting from the enforcement of any ordinance or law

Money Orders And "Counterfeit Money"

We will pay for loss resulting directly from your having accepted in good faith, in exchange for merchandise, “money” or services

Forgery Or Alteration

We will pay for loss resulting directly from forgery or alteration of, any check, draft, promissory note, bill of exchange or similar written promise of payment in “money” that you or your agent has issued, or that was issued by someone who impersonates you or your agent.

Outdoor Signs

Inflation Guard

a. The Limit of Insurance will automatically

increase by the annual percentage

shown in the Declarations.

Money And Securities

(1) We will pay for loss of “money” and

“securities” used in your business

while at a bank or savings institution,

within your living quarters or the

living quarters of your partners or any

employee having use and custody of

the property, at the described

premises, or in transit between any

of these places, resulting directly

from:

(a) Theft, meaning any act of

stealing;

(b) Disappearance; or

(c) Destruction.

Do you have...

(a) Awnings;

(b) Gutters and downspouts;

(c) Yard fixtures;

(d) Outdoor swimming pools;

(e) Piers, wharves and docks;

(f) Beach or diving platforms or appurtenances;

(g) Retaining walls; and

(h) Walks, roadways and other paved surfaces;

Work supplies or other equipment that leaves the business premises

You add a location

Have significantly higher business during different seasons

Serve or sell alcohol

Mobile Equipment

Optional Coverage Endorsements

(1) Outdoor Trees, Shrubs, Plants and

Lawns Additional Coverage;

(2) Outdoor Property Coverage

Extension;

(3) Outdoor Signs Coverage Extension;

or

(4) Outdoor Signs Optional Coverage.

Additional Coverages – Electronic

Data and Computers

Fine

Arts Additional Coverage.

(1) Money and Securities Coverage

Extension; or

(2) Employee Dishonesty Coverage

Extension;

Replacement Cost vs. Actual Cash Value (ACV)

Replacement cost is the amount to replace or rebuild your home or repair damages with materials of a similar kind and quality without deducting for depreciation. Often the cost to rebuild a home in accordance with current building codes with new raw materials at current labor rates is significantly higher than the proceeds you would receive if you sell your home.

Actual cash value is the replacement cost of your home minus age and wear and tear. Many times an actual cash value policy does not pay enough to fully return your home to the way it was before an incident.

What is not covered?

Property off premises, boilers, unexplained missing property, loss or damage of fragile articles, outdoor swimming pools, outdoor antennas, fine arts, water

Land (including land on which the property is located), water or growing crops

Employer’s Liability and Workers Compensation

Should you buy Flood or Earthquake Coverage?

Flood – It is important to be aware that the typical homeowners or renters policy does not cover damages resulting from a flood. Flood damage can happen to you, no matter where your home, apartment, or business is located. You

can buy flood insurance even if your property is not located in a Special Flood Hazard Area (SFHA). Mortgage lenders, pursuant to federal law, may require homeowners to purchase flood insurance if the property is located in a high-risk flood zone.

Earthquake – Damage caused by sinkholes or earth movement are typically not covered by homeowners policies unless requested and specifically purchased at an additional cost.

Visit the following pages for more information on plan options